2006年1至10月瀏覽人次:80,000

筆者於11月19日的股評談及「若不想坐這隻風高浪急的資金船,筆者仍建議大家買入大快活(52),目標價$10以上,筆者未能於$8.2補貨,已於週五以$8.43再入2,000股」。股是貼中了,注雖押中但押得不夠,本想大快活(52)就算升也是勢水長流,筆者亦打算於上升途中不斷增持;怎知週三此股忽然一步到位,急升$1至$9.8,昨天曾再升上$10.5收$10.04,升是升了,但卻變得如其他熱炒股般風高浪急!

再說說大快活(52)及大家樂(341)的比較,未來兩年每股預測盈利後者較前者高兩成左右,若大家擁有相同PE,大家樂(341)的股價應較大快活(52)高兩成;大家樂(341)現價$13.64,即大快活(52)可見$11.36;以規模計給大快活(52)10%折讓的話,大快活(52)保守估計值$10.23;但進取點可看$11至$12,亦需留意大家樂(341)的股價走勢。

數年前投資者經常以此兩股作為Arbitrage的例子,Arbitrage即零成本投資,買強沽弱,即沽空大快活(52),套取資金買入大家樂(341),都Work咗好多年,但若最近一兩年再行此着,則什麼也輸突;大快活(52)已不再被揶揄,反而變成了企業成功改革斧底抽薪的好教材!

一大堆新股山東招金、建滔積層板、中國通訊服務、中國交通建設、真明麗、安莉芳、中煤能源、錦江酒店等行將大市,筆者最近工作繁重,抱歉應沒有時間逐一分析,希望有時間作簡評及表明筆者認購取態。但抽新股已變成了「非理性」的抽獎遊戲,「理性」的分析已淪為輔助工具罷!

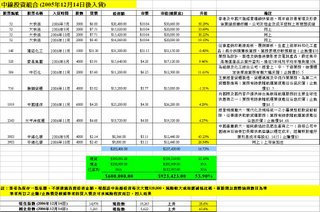

中線投資組合方面,筆者以$6.23沽出華能國際(902),損失數百元;另外,增持航運股,買入中國遠洋(1919)及太平洋航運(2343)。

(按一下下圖可放大)

(Contact: redmonkey@redmonkey.hk)

免責聲明:本網頁屬個人網誌,一切言論並不構成要約、招攬或邀請、誘使、任何不論種類或形式之申述或訂立任何建議及推薦,讀者務請運用個人獨立思考能力自行作出投資決定,如因相關言論招致損失,概與本人無涉。(投資涉及風險,證券價格可升可跌)

5 comments:

I thought Arbitrage involves the concept of risk-free?

So 沽空大快活(52)買入大家樂(341) shouldnt be called as an arbitrage strategy?

Sam

請問有哪些新股值得抽?

山東招金

建滔積層板

杭州奧普浴霸

中國通訊服務

中國交通建設

錦江酒店

真明麗

安莉芳

中煤能源

- John

Hi Michael,

I was reading your calculation of companies' value in your posts back in August. I have limited knowledge in companies' valuation and it would be great if you could tell me about where I can read about your method adopted? Or is it based on your own derivation? How do you come up with "每年預期回報"? Is it the "expected profit growth per year"? And I believe that the "以profit計預期估值" figure is being calculated by dividing "profit per share" by 每年預期回報, right? But isn't this the formula for "Present Value for a perpetual annuity", of which the denominator is the interest rate? If the denominator is the expected profit growth per year, then with the calculation, wouldn't the resulting value be actually decreased if the "expected profit growth per year" is increased? And this confuse me here. Sorry if you have explained this somewhere else already.

Thanks

Vincent

Sam,

Please read the definition of arbitrage from the below link

http://www.riskglossary.com/link/arbitrage.htm

You are talking about "true arbitrage" and I am talking about "speculative arbitrage"

Speculative arbitrage 的重點是invest without capital (No cost investment)

Arbitrage最理想是同一隻Asset於兩個市場有不同價,便可低買高沽,通常是大户遊戲;沽空大快活(52)買入大家樂(341)則有一點變種,由「同一隻Asset於兩個市場」變成「同一類Asset於同一個市場」,但Concept仍是「Buy Underprized,Sell Overprized」。

John,

其實筆者於11月24日的股評已回應如下

「一大堆新股山東招金、建滔積層板、中國通訊服務、中國交通建設、真明麗、安莉芳、中煤能源、錦江酒店等行將大市,筆者最近工作繁重,抱歉應沒有時間逐一分析,希望有時間作簡評及表明筆者認購取態。但抽新股已變成了「非理性」的抽獎遊戲,「理性」的分析已淪為輔助工具罷!」

Redmonkey

Vincent,

每年預期回報is the expected rate of return by investing in this stock. The more the risk of the stock, the more the expected rate of return to compensate for the additional risk borne.

According to "Present Value for a Perpetual Annuity"

以盈利計預期估值 = 每股盈利 / (每年預期回報 - 盈利平均年增長)

To be conservative, assume 盈利平均年增長 = 0. Then, 以盈利計預期估值 = 每股盈利 / 每年預期回報

Thus, the logic should be that "incresaing 每年預期回報 is due to larger risk of stock, which resulted in smaller 預期估值" with the same 每股盈利

Redmonkey

Post a Comment