2006年1至10月瀏覽人次:80,000

工作繁重,今天不能詳述,有關問題週日才解答!

週二震完倉,接着兩天又回復生氣;筆者於週二也被震走幾隻貨,包括優質的中石化(386),今天計已反彈不少,也沒有辦法,這就是筆者一直能在股市持盈保泰之道,亦配合筆者於股評右上方的簡介

「筆者投資屬保守的進取型,風險大小股票都會投資,但一開始已抱着「止賺止蝕」為座右銘,並積極觀察週遭投資氣氛,致使1997年股災能全身而退,2000年科網股爆破時更大賺特賺;但因傾向保守,牛市時有時會賺得比別人少!」

有興趣便看看筆者於這個牛市會否賺得比別人少?泡沫爆破時又會否再一次走避得及?

筆者今天亦趁市况回升再入貨,以$7.09買入雅居樂地產(3383)及$5.03買入中國建材(3323);週一買入的恆安國際(1044)力守50天平均線一段時間後今天暫時重拾升軌,目標價$20以上,此股有實力,但需留意走勢反覆。

大快活(52)昨天公佈中期業績,表面純利持平,即引起股價下跌,看深一層,去年賣物業賺了不少,撇除此特殊盈利核心業務盈利升七成,絕對不差;計及去年Special Dividend,今年派息少了兩仙,但Regular Dividend卻由$0.1增加六成至$0.16,顯示出管理屬對公司業務及現金流的信心;筆者認為大快活(52)消化一下上兩週升幅後,中線可再試高位$10.5;筆者會再詳談此股。

另外,筆者已以孖展認購中通服務(552),但預留更多彈藥認購中國交通(1800)及中煤能源。

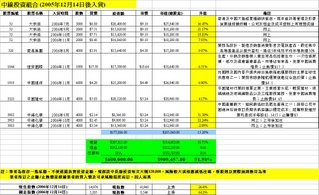

(按一下下圖可放大)

(Contact: redmonkey@redmonkey.hk)

免責聲明:本網頁屬個人網誌,一切言論並不構成要約、招攬或邀請、誘使、任何不論種類或形式之申述或訂立任何建議及推薦,讀者務請運用個人獨立思考能力自行作出投資決定,如因相關言論招致損失,概與本人無涉。(投資涉及風險,證券價格可升可跌)

2 comments:

Hi Michael,

I think I have kind of guess what you will do with your long term investments from your post today about your recent reaction to the big "shake" - that you will cut lost no matter whether the fundamentals of the companies have changed or not when bear comes. So don't bother to answer my question on that if that is it.

It would be good if you could advise on how you decide on the risk of the stock with your calculation of value (the first question on my last comment).

And I also want to say that I have learnt quite a lot by reading your blog. Thanks for the sharing.

Vincent

Vincent,

Thanks for your support.

Yes, I will sell them no matter it is fundamentally good or not, especially if it is overprized.

For example, I sold Cheung Kong (1) at about $140 in early 2000 as the extremely good market atmosphere might collapse the market later. Everyone knows that Cheung Kong (1) is fundamentally good, however, it was overprized in large degree just due to market atmophere and flow of capital. Until now, Cheung Kong (1) has not reached such historical high afterwards.

Although HSBC(5) is always fundamentally good. However, in bear market, it can still drop to lower than $100.

I invest in stock market in conservative approach. Therefore, as mentioned, it makes me gain less than other people in the bull market, however, I can lock in my profits in the bull market and at last win over most of the people.

Redmonkey

Post a Comment