2006年1至9月瀏覽人次:70,000

今天報章做了一個小回顧,分析最近十數年恒指走勢,每每於創歷史新高後例必調整,調整完後便再展升浪,很配合筆者預測的走勢,值得看看下圖參考一下

(按一下下圖可放大)

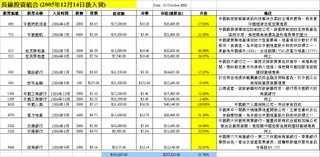

筆者今天沽了利豐(494)及首都機場(694),為組合再帶來$10740盈利;沽貨套利行動應暫時結束,套現資金部分增持2,000股大快活(52),不排除再買其他貨

利豐(494):$15.85買入,$20.4沽出

首都機場(694):$4.58買入,$4.99沽出

(按一下下圖可放大)

又到一週突破52週新高股票回顧

東方海外(316)

如筆者之前預測,繼中海發展(1138)及太平洋航運(2343)後,又一隻航運股突破新高

一批中國電力股

華能國際(902)、大唐國際(991)、華電國際(1071)、中國電力(2380)回落後再破新高,現價不太貴,有力再上;較看好大唐國際(991)

神州數碼(861)

上週股價默默突破今年4月所做高位,2006年及2007年預期每股盈到$0.36及$0.44,目標價可達$4.4

(Contact: redmonkey@redmonkey.hk)

免責聲明:本網頁屬個人網誌,一切言論並不構成要約、招攬或邀請、誘使、任何不論種類或形式之申述或訂立任何建議及推薦,讀者務請運用個人獨立思考能力自行作出投資決定,如因相關言論招致損失,概與本人無涉。(投資涉及風險,證券價格可升可跌)

3 comments:

Why sell 694, isn't that a good long term investment

Michael,

What do u think of the market? Do you expect the market will have adjustment?

Although I think that it should happen, it seems not recently!

I agree that adjustment is coming silently.

Calvin

My target price for 694 is $6. However, owing to recent market concern and high debt ratio, it is relatively not attractive.

Why sell? I have explained it in blog on 2 Nov.

Calvin,

Keep my views on short-term adjustment in the near future despite this week rise. Please read my blog on 2 Nov.

Redmonkey

Post a Comment