(按一下上圖可放大)

新股精熙國際(2788)IPO,2月3日中午截止,表面證供頗佳,可留意!

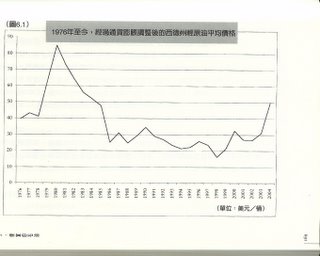

筆者再談談商品,先看看下面兩幅圖(按一下上圖可放大),是過往30年的油價(經通脹調整)及過往40年的糖價(未經通脹調整)。

筆者現年三十多歲,還記得小時侯,即二十多年前,尚未知道投資為何物,常常看見電視新聞會報導期油價、期糖價等,覺得非常有趣;不過懂事後卻再沒有印象見過相類的報導,為什麼?從以上兩圖應可參透一二!

原來商品在二十多年前曾風光一時,接着卻經歷了非常長的下跌週期,傳媒也不屑報導這種投資產品,幾年前終於止跌回升,猜猜上升週期會不會這樣快完結?

(Contact: micjacq@gmail.com)

2 comments:

hi, looks you are pretty good at stock pick. Just one thing, I also bought some 915 at 2.15. I have doubt about it as it's turnover of last year increased a lot but the revenue just increased a bit...it might not be a good sight. I bought it because I think the asset of Dowry Peacock is quite good. What do you think?

Toby C

hi, looks you are pretty good at stock pick. Just one thing, I also bought some 915 at 2.15. I have doubt about it as it's turnover of last year increased a lot but the revenue just increased a bit...it might not be a good sight. I bought it because I think the asset of Dowry Peacock is quite good. What do you think?

Toby C

Post a Comment